Service engineers have a reputation for being kleptomaniacs – I should know, I used to be one. They can be hoarders when it comes to parts. I get it. They’re just trying to do their job with minimum fuss or delays.

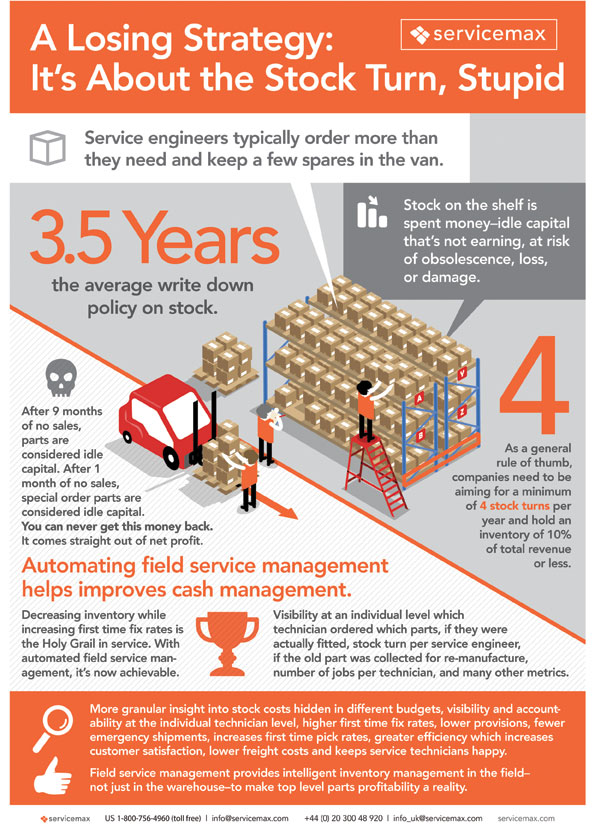

More often than not, when faced with a spare part problem, service engineers will typically order more than they need and keep a few spares in the van, just in case. You never know – future jobs may have the same issue.

The theory is that this approach will save them time. Well yes, if that part is actually needed on a regular basis, in which case it should be reported back as there is clearly a consistent fault somewhere. But what if it isn’t needed? And how long do you keep it?

The problem is that inventory can be a huge cost to the business, large or small. It ties up large amounts of cash, often unnecessarily. That’s because stock on the shelf is spent money. It’s idle capital that’s not earning anything, not providing any return, and at risk of obsolescence, loss, damage or all of the above. If the stock isn’t turning, you’re not earning.

Businesses typically have an average write down policy of three and a half years. Depending on your industry, stock parts are considered idle capital after nine months of no sales, but special order parts are considered idle capital after one month of no sales. After all, special order parts were already sold when they were ordered and if they are still there after one month, you have a problem.

It’s essential for any business to manage its stock as efficiently as possible. As a general rule of thumb, we advise that companies need to be aiming for a minimum of four stock turns per year and hold an inventory of ten percent of total revenue or less. It improves cash management. Decreasing inventory while increasing first time fix rates is the Holy Grail in service. Thanks to automated field service management, it’s not just possible, it’s common place.

It used to be the case that inventory management was tracked and measured in the warehouse and expensed on distribution - great for the accountants but not great if you want to see how and where and when parts are consumed; certainly not good if you want P&L by customer or contract! But thanks to intelligent automated field service management software, behaviours and requirements can now be measured in the field. Businesses can measure how individual technicians order (e.g. rush or standard delivery), how they consume, consumption to storage location, consumption to machine/equipment, as well as taking into account installed base and historic demand. All of this gives you a much more accurate picture on the levels of stock to be held, based on criticalities of demand (is it cosmetic or mission critical), how many have been used and how often they need to be replenished.

In other words, you can now see at an individual level which field service technician ordered which parts, if they were actually fitted, what the stock turn is per service engineer, as well as a host of other metrics, including whether the old part was collected for re-manufacture, number of jobs per technician, and a slew of other metrics.

This sort of insight doesn’t just give you visibility and accountability at the individual technician level, it also delivers significant savings. One multi-national company I know released more than $12.5 million in cash by implementing this process. Automating field service management gives you higher first time fix rates, lower provisions, fewer emergency shipments, increases first time pick rates, and therefore gets the job done more efficiently, which of course increases customer satisfaction, lowers freight costs and keeps the service technicians happy.

This level of sophistication can also give a business more granular insights into stock costs, which are often hidden in different budgets. For example, while the purchase cost of the part may be relatively low, the cost of the purchaser, the transport, storage, damage, interest, insurance and so on – all add additional costs to each part. You can never get this money back and it comes straight out of net profit. By drilling down into the total cost of ownership of each part, businesses can really ensure that each job has the best chance of being profitable and that money is not being wasted unnecessarily on over ordering or obsolete stock.

Top level parts profitability doesn’t just happen by accident. It takes understanding and planning, as well as real time visibility and accountability of frontline service teams. With field service automation, businesses can start to manage their stock more efficiently to minimise idle capital and improve parts delivery. It’s time to make intelligent inventory management a reality - not just in the warehouse, but in the field, where customer satisfaction ultimately lives or dies.

Dave Hart is Senior Vice President of Customer Success for ServiceMax.

Add new comment